Persona Pro— the pioneer in personalized health

Persona Pro makes it easy to create a personalized, daily supplement regimen for your patients.

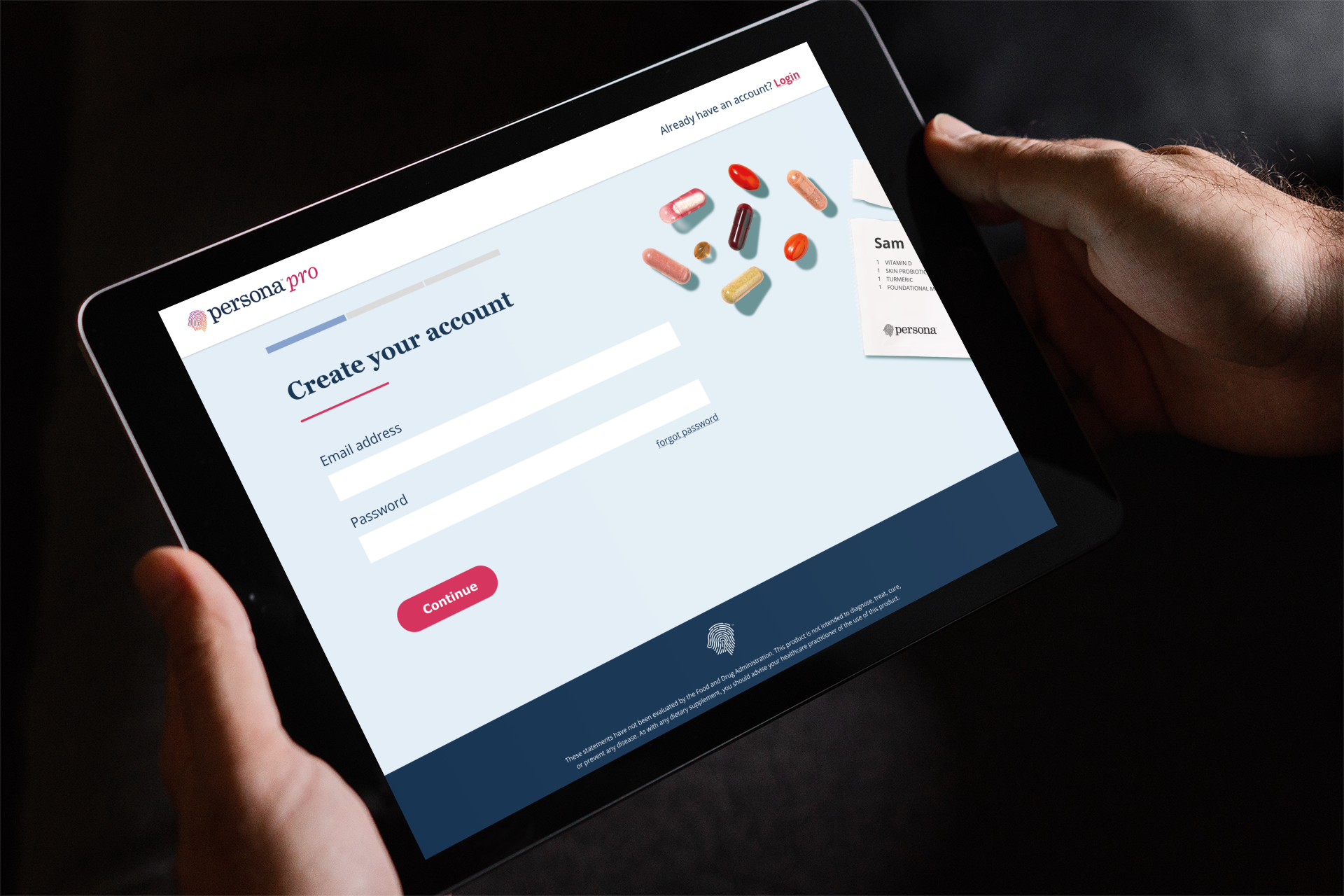

GET STARTED WITH PERSONA PROAlready have a Persona Pro account? Login

Persona Pro is a platform designed to empower healthcare providers with the ability to deliver ongoing, personalized supplement regimens tailored to each patient's unique health needs. With a seamless, turnkey solution, Persona Pro makes it easy for practitioners to provide consistent, adaptable support that enhances patient outcomes and builds long-term relationships.

HOW PERSONA PRO WORKS

1

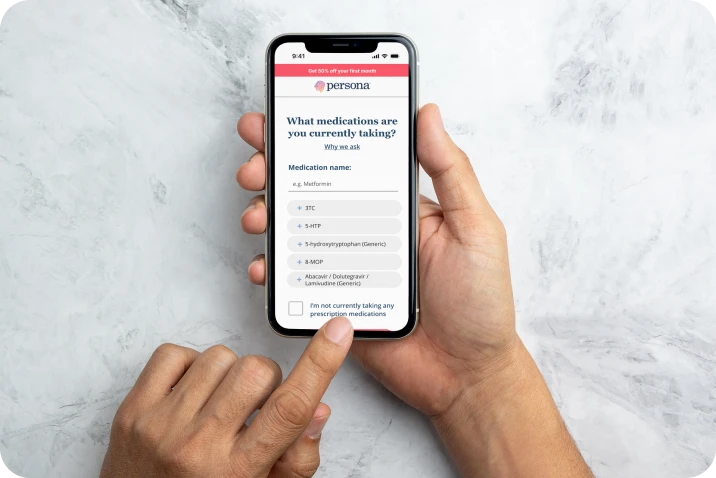

- Patients complete a quick, science-backed assessment that generates a customized supplement program based on their health profile.

- These recommendations are sent directly to you for review and further customization, allowing you to ensure they align with your clinical insights.

2

- Prefer a hands-on approach? You can skip the assessment and create a fully personalized regimen based on your patient's consultation and diagnostics results.

3

- Once the patient's regimen is finalized, they're enrolled in a monthly subscription. This ensures they receive their custom supplements each month, supporting consistent progress toward their health goals.

- Flexible Adjustments: As their provider, you maintain full control over their regimen and can adjust or update their supplement plan as their health needs evolve.

Persona Pro delivers highly targeted and effective personalized care, ensuring patients stay connected with their practitioners for real-time, proactive support.

User-friendly platform

With Persona Pro's user-friendly digital platform, there's no need for costly or complex infrastructure.

Quality personalized

support

Persona Pro enables you to provide high-value, personalized nutrition support, setting your practice apart as a leader in holistic, personalized care.

Effective patient

treatment

Persona Pro offers valuable insights into patient adherence and outcomes, helping you make informed adjustments to their plan for more personalized, effective treatment.

Integrating Persona Pro into your practice can improve patient wellness, offering transformative benefits to elevate the care and outcomes you provide.

Keeps you connected

Offering ongoing, personalized supplement regimens keeps patients connected to your practice beyond routine visits.Â

Real-time care

You can make real-time adjustments to their regimen, building a continuous, proactive care relationship that fosters patient loyalty.

Targeted patient care

Patients benefit from consistent, targeted supplementation that adapts to their evolving health needs, which can support better outcomes and enhance satisfaction.Â

SCHEDULE A DEMO!

We'd love to show you what Persona Pro can do for your practice. Schedule a demo with one of our onboarding specialists.

Or if you're ready to get started, create your Persona Pro account here.

SCHEDULE A DEMOGrow Your Practice With Persona Pro

GET STARTED NOWLet's clear things up

Have questions? We've got answers.

We can answer your questions and get the help you need.

Check out our full list of FAQs here.

Yes! We offer a variety of supplements that support healthy sleep-wake cycles. We suggest starting with our assessment to identify what sleep support supplement is the best fit for you.

Here's a link to our products page. From here, click on "Sleep" to see a complete list of our supplements that support sleep.

You can also add these supplement options to your order. See "Can I customize my order/How do I add and remove supplements?"

Yes! We have several supplements that support energy. Each supplement works in a unique way to support your energy levels. Here's a link to our products page. From here, click on "Energy" to see a complete list of our supplements that support energy. We suggest starting with our assessment to identify what energy support supplement is the best fit for you. You can also add these supplement options to your order. See "Can I customize my order/How do I add and remove supplements".

There are many things to consider in supporting your weight loss goals. We always recommend eating a whole foods-based diet, focusing on lots of fruits and vegetables. We offer a variety of supplements that can support your wellness journey by supporting blood sugar balance and encouraging a healthy appetite.

Here's a link to our products page. From here, click on "Diet & Lifestyle" to see a complete list of our supplements that may provide support on a healthy weight loss journey.

We suggest starting with our assessment to identify what weight control supplement is the best fit for you. You can also add these supplement options to your order. See "Can I customize my order/How do I add and remove supplements".

Every product that leaves our manufacturers, comes with a Certificate of Analysis to prove the dosage of what is in the product and what is not. We do not send out any product without this information from our manufacturer and follow strict standards of practice to ensure this is followed with every batch received.

Yes! You can customize your order anytime by logging into your online account. On our homepage, select "Sign In" in the upper right-hand corner of the web page. Once you have signed in, select "Change Order" on the left-hand menu. From here, you can add or remove supplements under the "Next Order" tab.

Most people don't consider the interactions that can occur between supplements and medications which can affect efficacy. To lessen the chance of interaction, Persona makes sure to eliminate all supplements that contain ingredients that might react adversely with your medication(s). It's important to consider your current medications before starting a nutrition program.